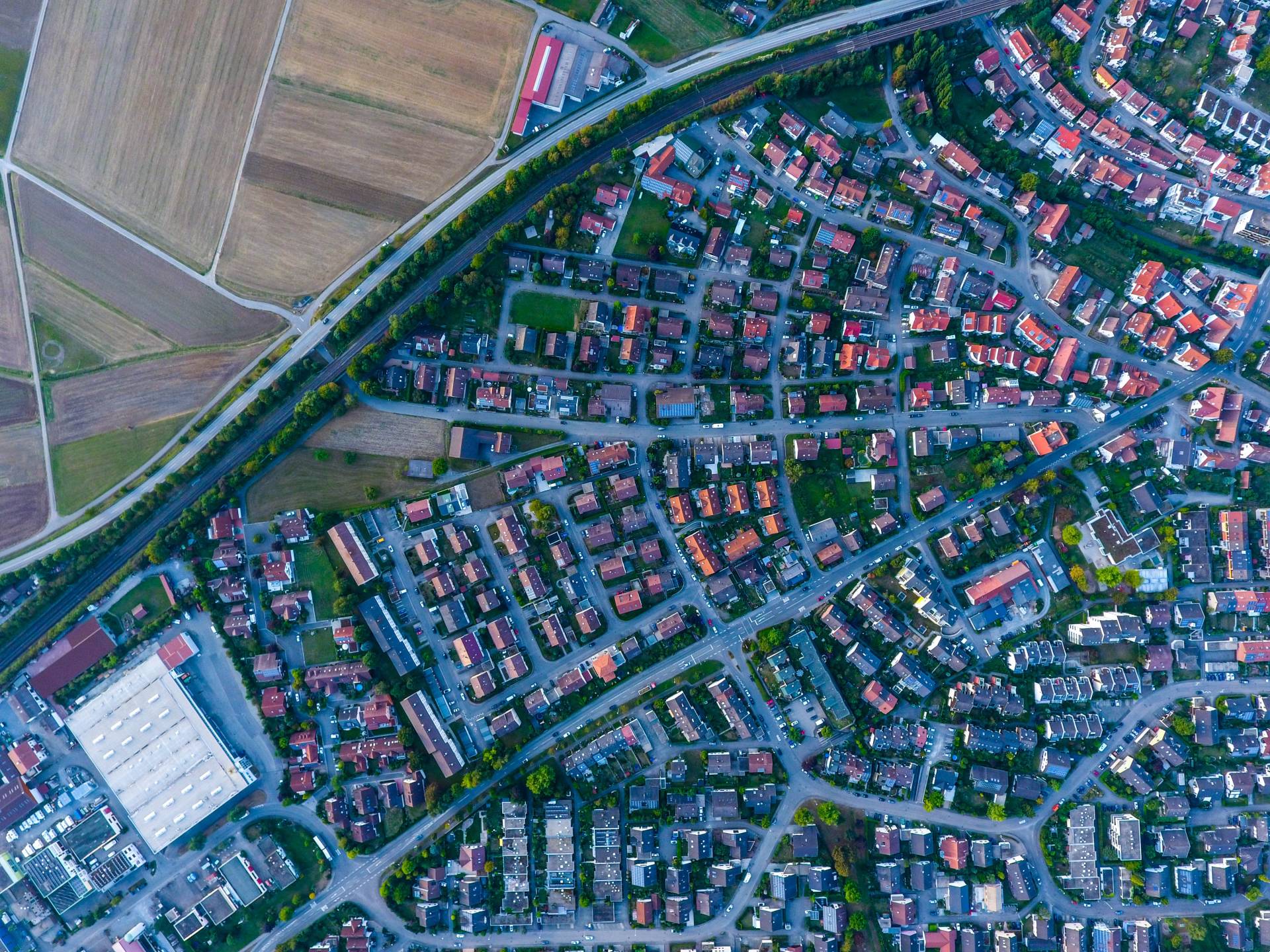

Unlocking the Secrets of Insurance Rates: Unraveling the Location Factor

Location significantly influences property and casualty insurance rates, and this includes variations in state guidelines. Each state has its own set of insurance regulations, which can impact coverage requirements, policy options, and pricing. In this blog, we will explore how location affects insurance rates, factors insurers consider when assessing risk based on location, and the importance of understanding state-specific guidelines when securing property and casualty insurance.

Geographical Risk Factors and State Variations: While geographical risk factors like climate, natural disasters, and crime rates affect insurance rates, it’s important to note that state guidelines can also play a role. Here are a few examples of how state variations can impact property and casualty insurance rates:

-

Minimum Coverage Requirements: Each state establishes its own minimum coverage requirements for auto and property insurance. These requirements can differ, impacting the cost of insurance premiums. For example, states with higher minimum liability limits may have higher rates compared to those with lower requirements.

-

Legal and Liability Factors: State laws regarding liability, negligence, and insurance claims can vary. Differences in tort systems (such as no-fault or fault-based systems) can influence the likelihood of lawsuits and affect insurance rates accordingly.

-

Building Codes and Regulations: State building codes and regulations can vary, influencing construction standards and resilience against natural disasters. Properties built to higher standards may have lower insurance rates due to reduced risk.

-

Catastrophic Risks: States prone to specific catastrophic risks, such as hurricanes, earthquakes, or wildfires, may have unique insurance guidelines and coverage options. These variations can impact rates to account for the increased risks associated with specific geographical areas.

Navigating State Guidelines: Understanding state-specific insurance guidelines is crucial when securing property and casualty insurance. Here’s why it matters:

-

Compliance: Complying with state-mandated minimum coverage requirements ensures that you meet legal obligations. Failing to meet these requirements can lead to penalties or the denial of claims.

-

Adequate Coverage: State guidelines may outline specific coverage requirements or recommendations based on unique risks within the state. Understanding these guidelines helps ensure you have the right coverage to protect against state-specific risks.

-

Policy Options: State variations can affect the availability of certain coverage options. Familiarizing yourself with state guidelines helps you explore available policy options and make informed decisions that align with your needs and budget.

Importance of Location Analysis: Analyzing the effects of location on property and casualty insurance rates is crucial when securing insurance coverage. Here’s why it matters:

-

Budgeting: Understanding how location influences insurance rates helps you plan and budget for insurance costs. It allows you to anticipate potential premium variations and make informed decisions.

-

Risk Mitigation: Recognizing location-related risks enables you to take proactive steps to mitigate them. Installing security systems, reinforcing properties against natural disasters, or implementing safety measures can help reduce risks and potentially lower insurance rates.

-

Coverage Adequacy: By assessing location-specific risks, you can ensure that your insurance coverage adequately protects you against potential hazards. This involves understanding the terms, limitations, and exclusions of your policy to address specific risks associated with your location.

-

Insurance Provider Selection: Different insurance providers may have varying risk assessments and pricing models for different locations. By comparing quotes and policies from multiple insurers, you can find the best coverage and rates tailored to your specific location.

When considering property and casualty insurance rates, it’s essential to understand that location encompasses not only geographical risk factors but also variations in state guidelines. State-specific regulations can impact coverage requirements, policy options, and pricing. By understanding these guidelines, you can ensure compliance, obtain adequate coverage, and make informed decisions that protect your assets. Partnering with knowledgeable insurance professionals like Best Formula Insurance ensures you receive expert guidance tailored to your state’s unique insurance landscape.

Tags: Best Formula Insurance, coverage requirements, geographical risk factors, Insurance insights, insurance premiums, insurance pricing, insurance rates, insurance regulations, location effects, location-based insurance, policy options, property and casualty insurance, property location, risk assessment, state-specific guidelines, understanding insurance costs